Walker School Board Cannot Be Allowed To Double Down On Failure

Part One

“surely taxpayers should be worried about how the increased revenues from school property taxes will be spent to arrest the abysmal reading literacy rates among students and who will lead that charge this coming year as well as the years beyond. To ignore the past while asking more of the future is a betrayal of the public trust.”

There are two groups of citizens with a lot at stake this week and most of them are not even aware of it. More at stake than any group has had in a long time. The first group are students and parents currently in Walker County Schools. The second consists of property owners in Walker County whose property taxes overwhelming flow to the public school system in the county more than any other government entity.

Let's start by talking about accountability. We can all agree that education is an economic good. Whenever the public pays for an economic good, it makes sense to ensure that what they're paying for is high quality and meets a standard. In order to ensure the best outcomes and highest potential for students and the community, accountability is crucial.

Unfortunately, when discussing accountability, taxes, and schools, discussions can devolve into teachers feeling attacked and dialogue becoming shouting matches that accomplish nothing.

Let me be clear: I am not attacking or blaming teachers.

Anyone who knows a teacher knows that he or she always aims for the best outcome. Furthermore, teacher evaluations aren't the public's responsibility. Can you explain the science of reading? Can you teach something that's totally unnatural to a bunch of kids addicted to screens in their pockets? I can’t and most everyone else can’t either. But school systems and superintendents are paid to make sure that exact task gets done. The job of the superintendent is to lead teachers, administrators, and schools to make sure the kids are meeting standards and leaving the system with the civic character, essential knowledge, and skills to pursue happiness and be productive members of society.

Surely, reading is the most basic and essential skill. There is a test in Georgia specifically to provide accountability in this regard. The image below will give you an idea how Walker County fares.

Suppose Walker County Schools were a business, and each student paid for a product (the ability to read) and 42%-55% of students did not receive what they paid for each year. How long would that be tolerated?

When children are not reading on grade level by the third grade, they are more likely to struggle academically and will face a higher rate of dropping out as well as incarceration.

It is impossible to overstate the importance of learning to read and becoming a good reader. Every school and student should make it their top priority. The success of students in this area at an early age is a prerequisite for every other aspect of education.

When you teach a child to read, they will be able to read to learn for the rest of their lives. It is worth noting that improvement in this area is a top priority in the recently unveiled district improvement plan. However, this has been the case for several years.

In Georgia, there are a number of district and school accountability measures and assessments, but the theme is evident in the simple chart above. The assessments are available here.

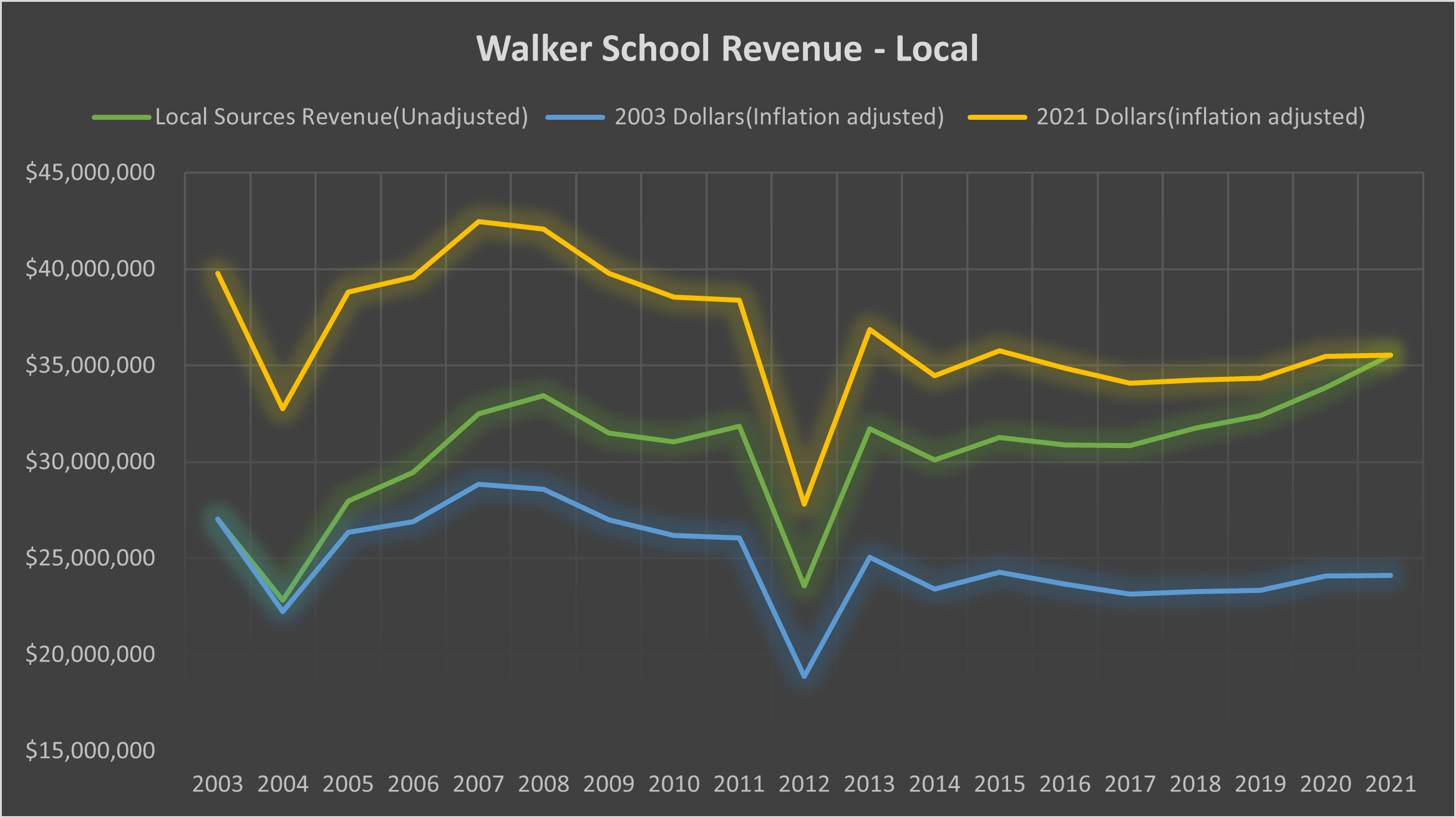

How much money does Walker Schools spend to post such abysmal results? In the first chart below, you can see how much state funding the school system received. It is represented by the green line in normal terms. Inflation is not factored in. In order to illustrate the effect of inflation, the top line is in 2021 dollars, while the bottom line is in 2003 dollars. The second chart illustrates revenue received from local sources.

The federal government also provides a smaller amount to the school system. In general, local revenue makes up about a third of the total school revenue. What is the source of local revenue? Taxes on property, primarily. The following chart shows the school portion of property tax history.

As reflected above, the superintendent has proposed an increase in millage rates. Make no mistake this is a significant tax hike.

For Walker County Schools, this is the highest increase on record. Moreover, while the tax levy has increased from roughly $20 million in 2012 to $27 million today, nearly 500 fewer students are enrolled.

A false belief is circulating out there that the tax assessor's office is responsible for the tax increase due to an increase in property assessments. Reassessments are mandated by state law, and they are a good thing since otherwise property values would not be uniform anywhere. Reassessments protect citizens and their investment in their homes and property.

To protect and inform property owners in the event of a tax increase resulting from an increased assessment Georgia Law requires that a rollback millage rate must be computed that will produce the same total revenue on the current year’s new digest that last year’s millage rate would have produced had no reassessments occurred.

The point needs to be emphasized. Under the law, a millage rate (called a rollback rate) must be calculated to produce the same revenue as the previous year. Whatever rate that is actually levied is up to the elected officials in charge of that taxing authority.

If a government elects to set their millage rate higher than the rollback rate, then the law imposes certain requirements.

The requirements are to hold three public hearings, place notices of the increase in the paper and issue press releases. This applies to all governments with taxing authority.

The Walker County School superintendent has proposed to the school board that the millage rate be set HIGHER than the rollback rate. The rollback rate to keep revenue the same is 14.0667. The rate proposed is 16.404. As such, three public hearings will be held. The first, will be rather soon: Tuesday August 9th at the advancing Education Center, 925 Osborn Road, Chickamauga on Tuesday, Aug. 9, at 5 p.m.

This explanation should prevent any attempt to blame tax increases on a reassessment, the tax assessor, or inflation alone. The governments are aware of the rate that could be set if they wish to keep the revenue amount the same.

Elected officials have the power to levy tax increases or decline to levy them at their discretion. Their decision is theirs alone. It is for this reason that accountability and transparency are so important.

Interestingly, property owners and citizens tend to scrutinize and voice their views more aggressively regarding municipal and county budgets and tax increases/decreases than they do regarding school system budgets. There should be a change to this.

No matter if you have kids in the school system or not, you should care about the quality of local schools and how money is spent. I can spend an entire post on that but let’s just agree that everyone should care about it.

If the public and the school board want to know whether the tax increase is justified, they should scrutinize it in public and hear from the superintendent and district leadership candidly. The proposed tax increase may well be necessary.

During a public discussion like that the question of accountability should be addressed candidly as well. If the tax increase is justified then surely taxpayers should be worried about how the increased revenues from school property taxes will be spent to arrest the abysmal reading literacy rates among students and who will lead the charge this coming year as well as the years beyond. To ignore the past while asking more of the future is a betrayal of the public trust.

The assessment data makes it clear that the public cannot ignore the school system as they have in the past. Citizens and parents must take action to demand accountability and action to stem the tide of failure in Walker County Schools. To be successful, we cannot continue to do the same thing over and over again. It is unacceptable to double down on failure.

READ PART TWO: Walker County Schools Going Woke? SEL Explained And Questioned

A very good and true article.