Charting The Course For Less Government and Better Service in Walker County

Start by asking what the government does and what does it do well.

Many years ago Ronald Reagan told us, “Man is not free unless government is limited.” I think most readers of this publication tend to agree with him. In 2021 however it is obvious that there is little interest in limiting the federal government. There hasn’t been a serious movement to restrain the federal government in quite some time. In fact it seems both parties are now on the big government bandwagon. Conservative columnist George Will describes the situation best “from Elizabeth Warren on the left to Ted Cruz on the right,” both parties are in agreement “we should have a large and generous welfare state and not pay for it. Everyone’s agreed on that”

Let’s assume that is true at the federal level. What about locally? After all we the people are closer to this level of government. Surely this level of self government is limited.

Not so much.

In 2000, all government and government enterprises in the county comprised just 7% of GDP in the county. In 2019 that number had more than doubled to above 15%.

What about taxes? Low taxes are a hallmark of modern conservatism and the republican party.

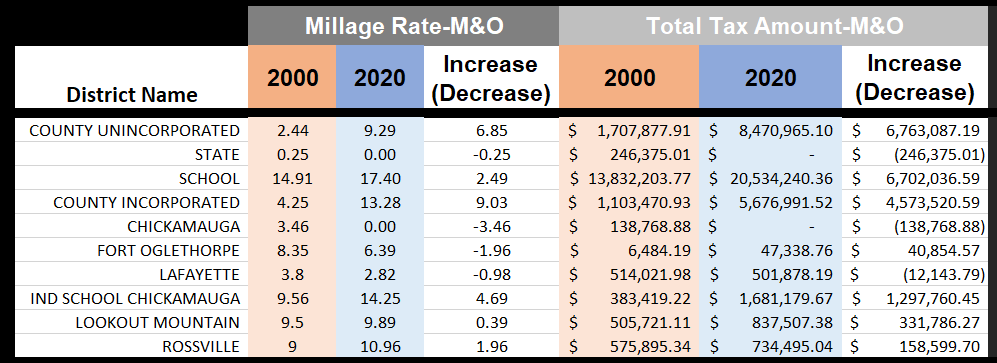

The millage rates levied by Walker County government have exploded since the turn of the century. Surprisingly, this has happened despite the fact the county did not have SPLOST nor TSPLOST in 2000. Are citizens happier now with the services from the county government? Ask 10 citizens about roadside mowing, roads themselves, the water company, or transparency and the answers given will trend to the negative.

When recognizing citizen dissatisfaction it is important to distinguish between individuals and the government. There is near universal feeling that the new board of commissioners in Walker County is a welcome change. They are off to a great start thanks in no small part to the financial acumen and committed plan executed by our last sole commissioner and new board chairman, Shannon Whitfield and his entire administration. The feeling abounds among citizens that the team leading Walker County today is the team for the job ahead. The dissatisfaction in government services does not necessarily equate to a dissatisfaction with the individuals in government. .

There are many underlying causes for this displeasure. But there are a few things that can be done and should be done to correct it. A few common sense steps will lay the foundations for a return to limited government in Walker County.

The Path To Limited Government

Start by asking what the government does and what does it do well. There are some things the government does well and some that are better left to the private sector. The first thing that comes to mind is mowing of roadsides and right of ways. It is no secret this has been a problem for years and the solution is to return to our conservative limited government principles. Privatize it and get the government out of the way. There are countless successful models for this across the state. When you think about the cost of the equipment, the maintenance of the equipment, the workers comp and various insurance requirements, and the fact all of this is only used half the year, it is easy to see how outsourcing the task to one or more private businesses is the smart choice for Walker County. Taking this step in no way means cutting jobs. It means being more efficient and focusing efforts and labor on what the government does well. .Outsourcing of mowing is but one proven option among many. How else might we limit government while also empowering citizens and businesses?

Better Data = Better Planning & Financial Savings

The next thing that can be done to put us back on the path of limited government is also the most important thing that must be done. The county commissioners should pass a measure to require the implementation of a comprehensive asset management program. Well, what is that? In your home you probably have a good idea in your head of all the items you own, how much you paid for each, their current condition, and how long until something will need to be replaced. You know that your roof has a lifespan of around 25 years so it’s easy to plan in your budget for it’s replacement. This is just a part of life for an individual but when applied to governments and businesses it becomes a necessary tool for long term planning. In the realm of government asset management we need to be meticulous and transparent. The asset lifecycle image below.

How does this work with some common assets?

For roads the benefits of an asset management program are innumerable. If we know when every road was last paved and track condition changes we can determine the remaining lifespan and the estimated cost for replacement when due. Funds can be set aside to be available when it’s time for replacement.

For county vehicles we should track the purchase price of every vehicle, the annual maintenance cost, the expected lifespan, the replacement cost at various points to determine the optimal time for replacement and various usage data so that we can easily see how many vehicles will need to be replaced in a given year far in advance and plan for those expenses.

Roads and vehicles are easy examples but asset management should be comprehensive in order to achieve the greatest benefit. From the tools in the maintenance shop to roads and county vehicles to every aspect of county facilities, with technology today it is easy to plan for the life cycle cost of every asset the county owns.

This is what is required for a capital planning budget. By implementing an asset management system we can then start to properly plan for capital expenses long term. This is standard operating procedure but the government, as always, is last to the party.

Humility

When was the last time you heard an elected official admit they were wrong or made a mistake or that a program or agreement they championed wasn’t effective or successful? It hasn’t happened often in the past 30 years. Again there are many causes for this but an easy way to encourage our public officials to embrace humility and candor is by cutting them some slack when they do. The nature of our political system is such that any admission of fault is seized upon as weakness and exploited by rivals. This aversion to fault finding is natural but unhealthy for civic life. It naturally leads to an attitude of reluctance toward transparency and resistance to evaluation and accountability efforts. Encouraging humility and candor from our leaders begins with citizens' willingness to grant leniency in exchange.

Transparency

In my column last week I outlined the continuing lack of transparency in Walker County. With an asset management plan should come better transparency. Consider the current situation. Ask yourself, could you easily determine how your tax dollars were spent last quarter? Not just how the funds were budgeted last fall but how the actual dollars were spent. I am a close observer of the government and I can tell you I have never seen that information readily or easily available for any given quarter. It doesn’t have to be this way. In the column last week I pointed out the failure by the county government to disclose tax abatements that reduce tax revenue. Those abatements are typically part of economic development agreements and incentive agreements. It is necessary for good government that this information be made public and that our government monitor the agreements for compliance and evaluate them to improve future agreements and incentives. If something isn’t working the way it was planned it is better to admit it and learn from it rather than ignore it and continue in blind ignorance. Our neighboring county to the north, Hamilton County in Tennessee offers an example Walker County government should seek to learn from and emulate.

On the Hamilton County website there is easy access to years of data on tax abatements and PILOTs or Payments in lieu of tax agreements as well as other incentive agreements. The images below are a sample of what is provided by Hamilton County. Each company is identified and links are provided to each government resolution approving the incentive agreement.

Hamilton County provides this wealth of information with simple spreadsheets and pdf documents. Walker County is legally required to disclose the information and should follow Hamilton County to embrace transparency and the benefits it provides.

The most recent stimulus from the federal government has given our local government the ability to allocate a fraction of the stimulus funds for foundational things like asset management and capital planning programs that are online and publicly available. These funds can also be used to enhance transparency at the same time. Citizens should be able to see every dollar that comes in each month and know where it comes from and know every dollar that goes out and for what purpose. Imagine if we had this type of transparency before our previous commissioner made all her mistakes without public oversight.

These common sense measures are foundations the new board of commissioners should put in place that will improve services, establish transparency standards, enable better planning, and lead to a return to limited government with lower taxes and satisfied citizens.

If there is reluctance or disagreement that these measures are necessary foundations then two questions should be asked before the 2022 budget is adopted. What will the capital expenses be for each department in each year for the next five years? And, what funds are allocated to pay for each individual item? SPLOST and TSPLOST are not adequate to meet the infrastructure and capital expenses the county has now and will have in the future. Conservative and prudent measures such as these are solid foundations the board can build on for long term prosperity.