A Property Tax Revolt in Georgia Is Brewing. Who Will Lead It?

Ending school property taxes bridges two worlds — populist anger and practical reform. With the right plan, it fixes education funding and slashes the burden on homeowners.

Property tax, n.: A government device by which you pay rent on land you allegedly own; a recurring proof that “private property” is a crappy time-share with the county government.

Milton Friedman once observed that property taxes inspire more rage than income taxes for a simple reason: you have to write the check yourself. Income tax vanishes before you ever see it, a magic trick of withholding that makes the government's hand in your pocket feel like a gentle breeze. But property tax? That's a punch to the gut twice a year, a bill that arrives with all the subtlety of a debt collection call at dinnertime.

This helps explain why the conservative tax-cutting wishlist might be on the verge of a rewrite. The classic Republican crusade against the income tax is losing ground to a fiercer, populist battle cry: get rid of the property tax.

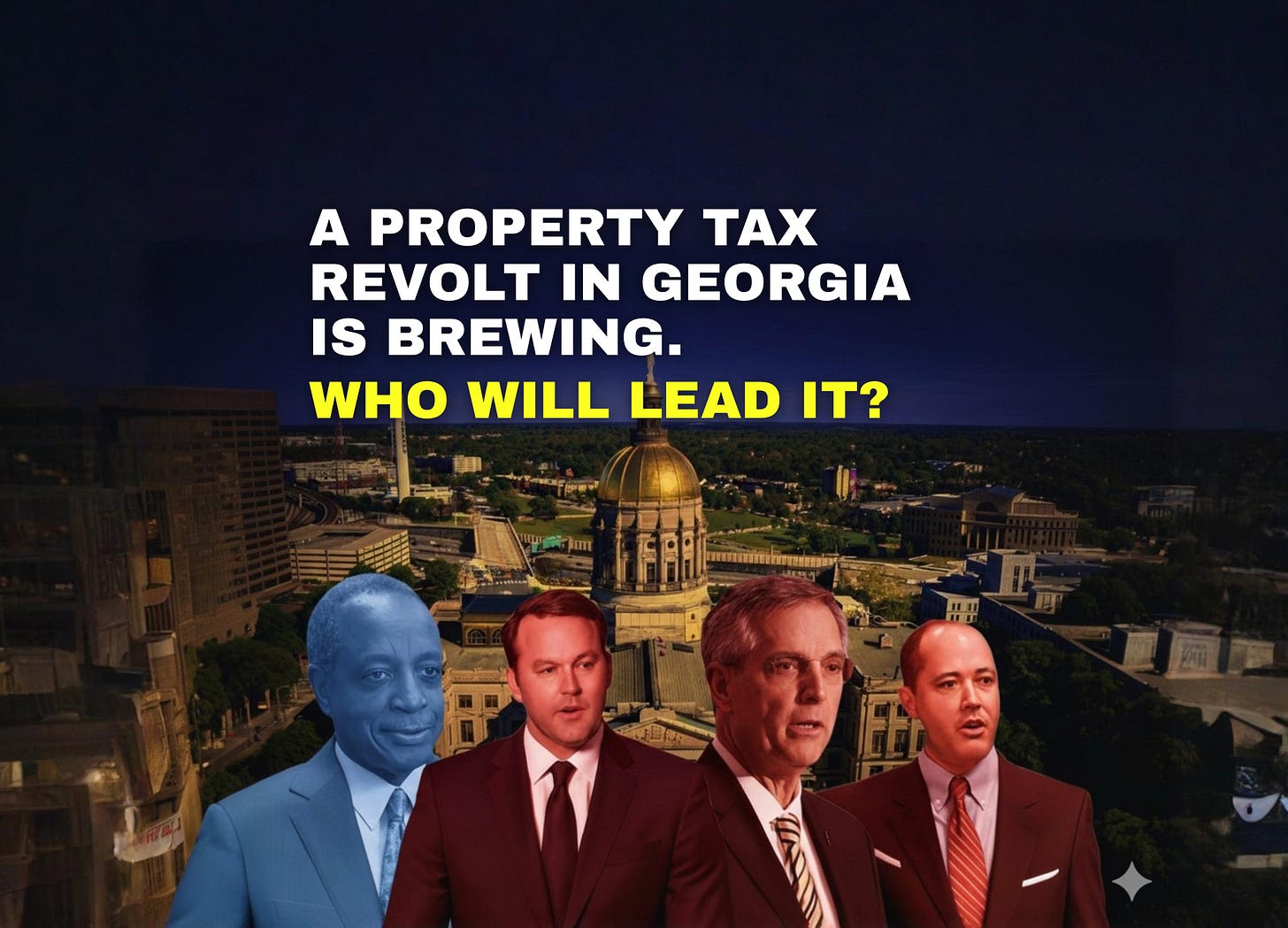

For years, Georgia Republicans have sung from the same hymnal: abolish the state income tax. Lieutenant Governor Burt Jones has made income tax repeal his signature crusade, positioning himself as the heir to a decades-old conservative orthodoxy. It's a fine policy position—one that appeals to the Club for Growth crowd and sounds appropriately Reagan-esque in Republican primary debates.

But down in Florida, Governor Ron DeSantis has been singing a different tune entirely. The firebrand governor who never met a culture war he couldn't win has pivoted to something far more tangible and immediate: abolishing property taxes altogether. Not reforming them. Not capping them. Abolishing them. It's a promise that resonates in every kitchen in America, where families sit around tables calculating whether they can afford to stay in their homes as assessments skyrocket.

The contrast is telling. While Jones offers Georgia voters relief from a tax that's already withheld from their paychecks—invisible money they never held in their hands. Governor DeSantis promises Floridians they'll never again have to write that check to the county tax commissioner, never again face the annual ritual of watching their property tax bill climb while their income stays flat.

Why Democrats Could Steal Populist Energy

Property-tax abolition isn’t just a rightwing fantasy. Framed properly, it could be the progressive dream ticket as well. It’s not an either or thing. Here’s why.

Georgia funds schools with a patchwork: part state, part local property taxes. The local part is where the problem hides. Wealthy areas and districts raise millions at low rates. Struggling rural or urban districts raise peanuts at higher rates. The formula that governs the state side—the Quality Basic Education Act of 1985, still unchanged—never included a “poverty weight.” It doesn’t give extra dollars for kids who grow up in poorest areas.

That means a kid in Buford and a kid in LaFayette are technically “equal” under the formula, but in reality, the Buford kid is sitting in a brand-new STEM lab while the LaFayette kid is sitting at a desks used by his parents when they were in school.

Republicans know this. Three GOP governors—Sonny Perdue, Nathan Deal, Brian Kemp—tried to modernize or replace QBE. None succeeded. Task forces, hearings, blue-ribbon everythings—no durable reform. That seemingly intractable failure and no GOP moves to abolish school property taxes leaves a mile-wide lane for a credible, non-shrill Democrat to say: end the school levy, force the state to fund schools fairly, and build a fair simpler QBE 2.0. You can hear the pitch already: equal opportunity, same promise for every kid, and—by the way—your property tax is slashed by 70%+.

Republicans should be losing sleep over a question: What if Democrats figure this out first?

This unique combination creates an extraordinary opening for a Democrat willing to think beyond progressive orthodoxy. A nightmare scenario for the GOP is that it is proposed by someone like recently announced candidate for governor Michael Thurmond—former DeKalb Schools superintendent, three-term labor commissioner, former DeKalb County CEO. Unlike most prominent Democrat politicians these days who sound like they recently broke out of the asylum or slick enough to sell you beachfront property in Nebraska, Thurmond speaks plainly and makes sense. He understands budgets. He knows education. Most importantly, he could credibly propose something revolutionary: abolish the local school district portion of your property tax bill entirely while reforming QBE to actually help kids who need it.

The beauty no matter who proposes it? It appeals to the widest swath of the electorate. Progressives get equity reform for education. Conservatives get a tax cut. Homeowners could save $500 to $1,500+ (60-80% of property taxes bill) annually. And if it’s Thurmond, suddenly, improbably…the Democrats could own a populist tax revolt.

The Republican Trap

Now picture the 2026 governor’s debate.

The moderator turns to the Republican candidate and asks:

“Do you support abolishing the school district portion of local property taxes, as your opponent proposes?”

There are only two answers, and both are bad.

Say yes, and you admit the Democrat beat you to the punch. You look like you’re playing catch-up or following.

Say no, and you’ve just declared yourself the defender of property taxes. That’s like volunteering to be the mascot for mosquitoes.

Republicans would scramble for talking points in the aftermath:

It’s not realistic—it’ll bankrupt schools.

It’s redistribution—your money will go to Atlanta kids.

We have responsible relief—bigger homestead exemptions, caps, circuit breakers.

None of that matters.

Voters won’t compare policy or position papers. They’ll compare tax bills and numbers. Democrats would be the ones promising to kill the most hated bill in your mailbox. Or the largest part of it.

Republicans would be the ones explaining why it’s complicated. When your opponent promises to eliminate a tax, offering to explain or at best to reduce it makes you the candidate of the status quo. In politics, “it’s complicated” loses to “here’s your money” every time.

Worse for Republicans, if Democrats seize the property tax issue, all the "woke politics" and culture issue attacks (that are effective and relevant) start to lose their sting. Hard to paint someone or a party as a radical leftist when they're promising working families the most conservative thing imaginable: keeping more of their own money. A Thurmond-type Democrat would sound less like AOC and more like Bill Clinton circa 1992—before he discovered what "is" means.

The Math Actually Works

Regardless of whether a Republican or Democrat seizes the issue, there will be skeptics who decry the idea to be impossible. Except it's not. Georgia's robust growth generates new revenue annually. A broadened sales tax—still lower than many states—could fill gaps. Phase it in over a few years. Guarantee no district loses funding through a reformed QBE 2.0 that includes poverty weights. Create a constitutionally protected education fund.

The revenue replacement challenge for eliminating school property taxes presents no greater complexity than Jones's income tax repeal proposal. The amounts are comparable. The difference is political and real world impact: income tax cuts feel abstract, while property tax elimination—even if it’s just the local school district portion of property taxes—hits every homeowner's bottom line directly and immediately.

Think about it. A young couple in a poor district with small children sees their annual property tax bill drop by 800 to 1,200+ while their kids' schools finally receive adequate, stable funding. A senior citizen on fixed income saves $1,100+ annually while knowing education funding won't depend on neighborhood wealth. And that PTA parent who saw the multi-million-dollar jumbotron in a suburban Atlanta school gym realizes poor districts might finally get fair treatment.

Down-Ballot Devastation

The implications extend far beyond the governor's mansion. The governor’s race is an open contest in Georgia next year. Also on the ballot will be a federal Senate race where Democrat Jon Ossoff sits under 50 percent approval and looks vulnerable. A Democrat running for Governor who seizes the property tax issue with a bold popular proposal could boost Ossoff's reelection chances while providing down-ballot candidates with a new populist economic message that transcends traditional partisan divides.

Republicans would find themselves defending an unpopular tax while Democrats promise relief. In a purple state like Georgia, that's electoral suicide.

Republicans should own this issue. It's a conservative dream: cutting taxes, empowering parents, forcing government efficiency. The fact that they've let it sit there like an unclaimed lottery ticket while Democrats are still looking at it like it’s an unclaimed bag at the airport they might recognize is political malpractice of the highest order. A quick look at its history reveals the Georgia GOP seems uniquely gifted at snatching defeat from the jaws of certain victory, but letting the left swipe this issue would be their masterpiece.

The clock is ticking. Every month Republicans spend debating income tax rates that most voters barely understand is another month Democrats have to recognize the gift sitting out in the open for the taking.

Property tax, n.: In Georgia, a line item begging for a political obituary, waiting for whichever party possesses sufficient nerve to write it.

The party that writes that obituary first will be in the driver's seat in Georgia politics for the next decade. Republicans have the natural advantage, policy credentials, and philosophical foundation to own this issue. Whether they'll seize the moment or gift it to Democrats shrewd enough to steal their thunder remains to be seen.

Lt. Governor Jones has made clear his commitment to income tax repeal. Attorney General Chris Carr and Secretary of State Brad Raffensperger both have a golden opportunity to seize rare populist power by proposing elimination of the local school district portion of property taxes. Will it happen?